Sector Rotation Breakdown: Spotting Market Leaders Now

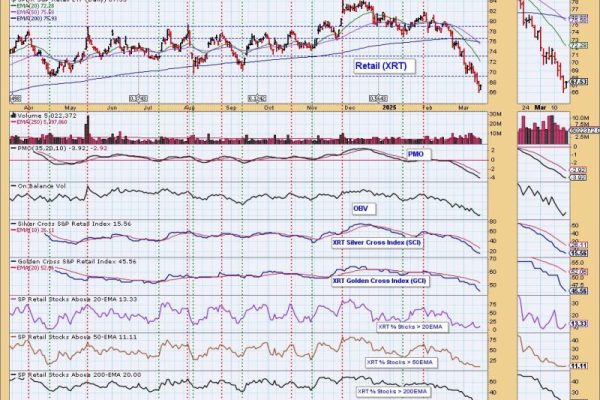

In this exclusive StockCharts video, Julius analyzes US sector rotation using Relative Rotation Graphs (RRG), starting with the 11 S&P sectors and breaking them into Offensive, Defensive, and Sensitive sectors to uncover unusual market rotations. He then dives into the Financials sector, identifying top stocks with potential for outperformance — even as the sector remains…